Four Low Down Payment Mortgage Programs Too many Americans who want to buy a home feel they can’t because they don’t have the cash to put 20 percent down on the mortgage. It’s safe to say that the down payment is one of the biggest obstacles to homebuying today. And, it doesn’t have to be. Here are four low down payment mortgage programs to get you in the home of your dreams. 1. Fannie Mae’s...

Home Buyers

Every homeowner wants to make sure that they maximize their financial reward when selling their home, but how do you guarantee that you receive the maximum value for your house? Here are two ways to ensure that you get the highest price possible. 1. Price it a Little Low This may seem counterintuitive, but let’s take a look at this concept for a moment. Many homeowners think that pricing their...

Mortgage Interest Rates Are Still Great! Interest rates hovered around 4% for the majority of 2017, which gave many buyers relief from rising home prices and helped with affordability. In the first quarter of 2018, rates have increased from 3.95% up to 4.45% and experts predict that rates will increase even more by the end of the year. The rate you secure greatly impacts your monthly mortgage payment...

Owning a home has great financial benefits, yet many continue to rent! Today, let’s look at the financial reasons why owning a home of your own has been a part of the American Dream for as long as America has existed. Zillow recently reported that: “In reality, buying or renting a home is an intensely personal decision, with emotional and even financial considerations that go beyond whether to...

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 3.92%, which is still near record lows in comparison to recent history! The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power. Purchasing power, simply put, is the amount of...

Mortgage 101 - What is a mortgage? A mortgage loan to finance the purchase of your home consists of five parts. Collateral Principal Interest payments Taxes Insurance When you agree to a mortgage you enter into a legal contract promising to repay the loan plus interest and other costs. Your home is collateral for that loan, if you fail to repay the debt the lender has the right to...

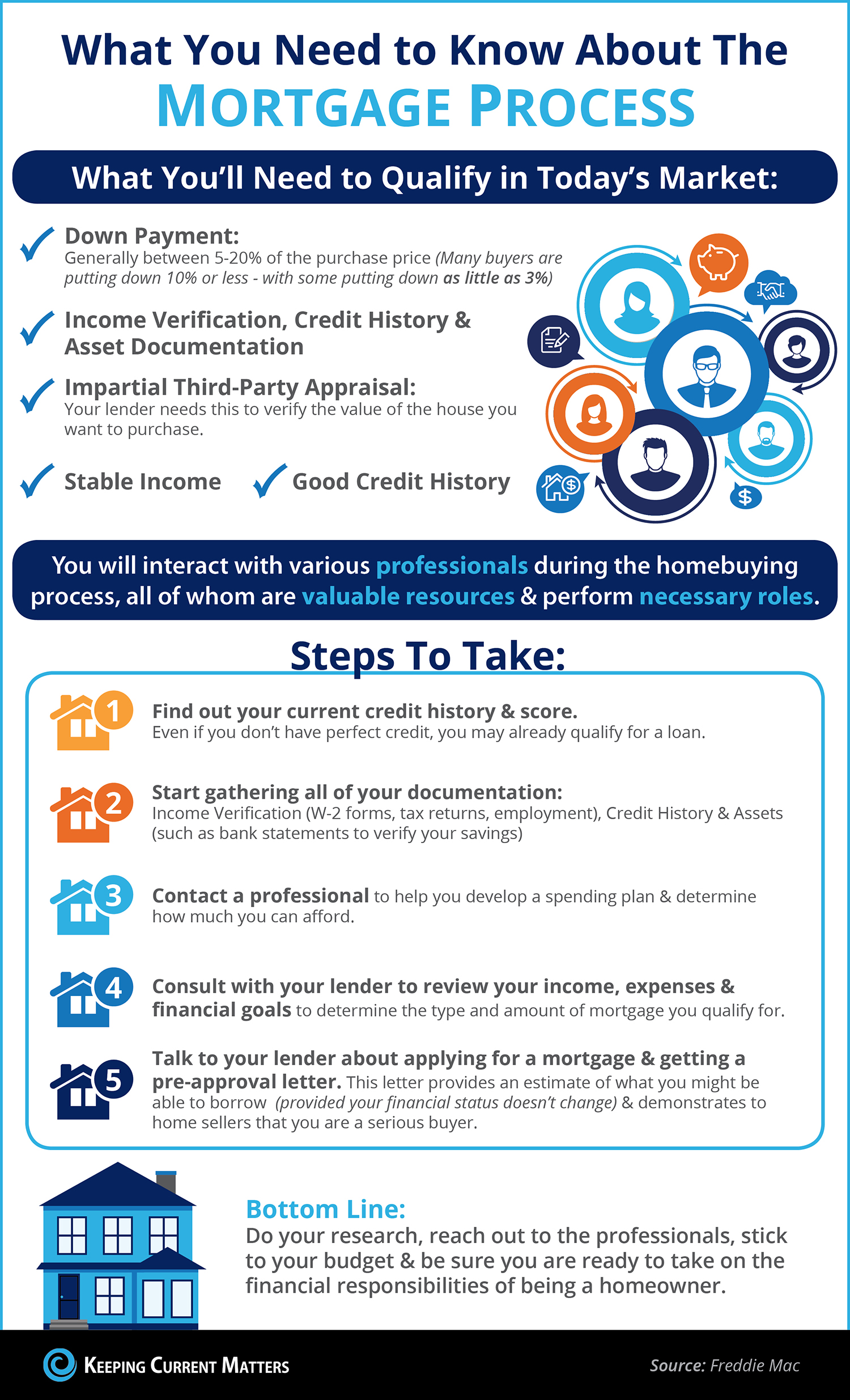

What You Need to Know About The Mortgage Process What you need to qualify in today's market: Down Payment - Generally between 5-20% of the purchase price. However, many home buyers are putting down 10% or less - with some putting down as little as 3% Income Verification, Credit History & Asset Documentation - the paperwork needed to apply for a mortgage on the balance of the purchase price of...

Their are many benefits to homeownership. One of the top benefits is being able to protect yourself from rising rents by locking in your housing cost for the life of your mortgage

Recently, Freddie Mac reported on the benefits of homeownership. According to their report, here are the five benefits that “should be at the top of everyone’s list.” Homeownership can help you build equity over time. Your monthly payments will remain stable. You may have some tax benefits. You can take pride in ownership. Homeownership improves your community. Let’s expand on...

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 3.96%, which is still near record lows in comparison to recent history! The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power. Purchasing power, simply put, is the amount of...

Home Buying in Six Steps 1) Get Ready for Home Ownership Build a good credit history Get mortgage pre-approval Find out what type of mortgages you quality for Consider hiring an attorney to review all contracts and agreements associated with the home buying process Save up for a down payment (typically 10-20% of property’s value; if FHA-qualified, then possibly less) Consider closing...

Spring is in the air, and you’ve got a few projects that you either know you can’t quite get to, or know you can’t quite manage yourself. It’s time to look for someone with a little more expertise and time to help you get the house in shape for the warmer weather. But then you run into a question: Do you need to hire a handyman or a contractor? And what’s the difference, anyway? The...

Relocating to a new home is a fairly tricky thing to do. You've got a great deal you must focus on, it's in no way easy to get every little thing completed without neglecting something. It could be a hectic occasion for both you and your household. The best way to preserve your peace of mind, along with that of your household, is to be prepared and all set to go. Creating a schedule for your forthcoming...

Generally, individuals move a minimum of twice during their lifespan. It is a simple fact that can't be ignored. Of course, at the same time there are folks that move a great deal more than that. They might be known as 'serial movers' in the eyes of everyone else. These individuals are normally tenants and end up relocating at the end of every lease. A number of them are looking for a far better cost;...

Are you still renting your home? If you are, then you're missing out on serious money which could have been going to your wallet. Below are a few ways lessees lose their money:1. It may be a cliche, but the truth is you really are repaying the landlord's property finance loan. You're going to be losing out on the appreciation that the building provides to the landlord. Appreciation is a phrase used by...